Why did Uber Buy Routematch?

By: Luke Mellor

Imagine if American Airlines bought Amtrak, that would be a head scratching acquisition. On one hand, the two companies are both involved in the provision of transportation, on the other hand they both take a completely different approach and it is doubtful that a soaring airline will want to help keep a clunking rail operator alive in its current form. That imaginary acquisition is analogous to a real acquisition that happened last week, Uber’s purchase of Routematch.

For those in the public transit industry this was a shock. For 20 years Routematch has been one of North America’s premier transit software companies, it is used by hundreds of agencies and every transit agency in North America has either used it or is well aware of it.

Acquisitions of transit software companies have not always been pretty. Chariot, a nascent crowd-sourced fixed route micro bus service was bought and killed by Ford. Although, Chariot’s business model was so unsustainable it is hard to blame Ford. Bridj, one of the very first movers in on-demand transit was almost acquired by Toyota, when the deal fell through it marked the end of Bridj. These are small moves in comparison to Uber’s purchase of Routematch. The strangeness of this recent acquisition can be summed up by Routematch Executive’s, now dated Q&A answer in regards to a question about Uber and Lyft that is inexplicably still on Routematch’s now Uber branded website:

“…Some of those walls are starting to be torn down. Definitely at the beginning, Uber and Lyft were seen as competitors. They disrupted the taxi industry. People were scared they were going to disrupt public transit. But the business model for Uber and Lyft is very different from public transit. They don’t have the same commitment to the community to do what public transit agencies are trying to do. By that I mean providing equitable services for all riders, whether it’s handling a mobility type or subsidizing the cost of the trip for an at-risk demographic. What Uber and Lyft did disrupt in public transit was the mindset.”

This opinion about Uber is shared by many in the industry. They see Uber as a mercenary element that does not want to play nice with other stakeholders in the public mobility space unless it can help them get press or free marketing. The ‘transportation network company’ business model applied by Uber has been a race to the bottom to generate taxi trips at the expense of all other modes of transportation. It is telling that in their IPO they explicitly stated that public transit was a competitor.

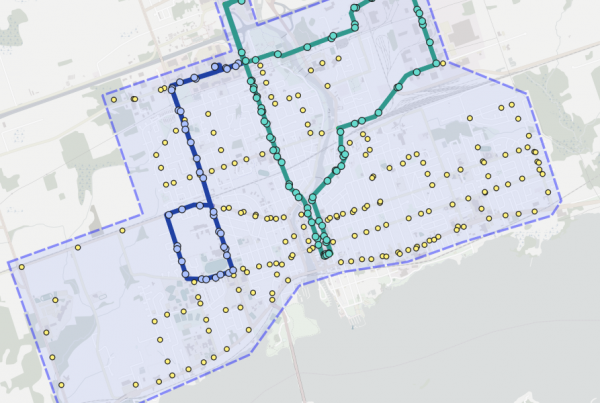

However in 2020, Uber has dramatically turned from trying to kill transit to trying to sell to it. This started in earnest in June 2020, with a Software-as-a-Service contract that Uber won to work with the Transportation Authority of Marin and the Marin Transit bus agency in California. It is important to note that this was a purely software play. No involvement with Uber’s normal fleet of rideshare drivers, Uber only provides the apps and other technologies necessary to provide on-demand transit services. Based on the performance of other attempts by Uber to provide “public transit” with their “ride pooling technology” we expect this pilot will not be much more than a public taxi service.

This new entry into directly selling to public transit agencies by Uber makes a lot more sense with the acquisition of Routematch. But it does leave many unanswered questions. Mainly about how Uber will use Routematch? The obvious approach would be Uber using Routematch as a bridgehead to gain access to more transit agencies for direct software sales or as a backdoor to replace under performing transit services with Uber’s taxi offering.

How many transit agencies will jump at the opportunity to replace their old Routematch bus software with Uber’s taxi software remains to be seen. But with COVID-19 still ravaging public transportation ridership and on-demand transit becoming more and more critical for transit agencies, we will probably see new entrants into this space from unconventional angles. Maybe Lyft will buy Trapeze next? Luckily for agencies that use Routematch now and worry about the future of the company, there are some good alternatives to provide efficient on-demand transit software without the baggage of Uber.

Image Credit: http://www.quotecatalog.com/